Net Income Can Best Be Described as:

Net income can best be described as A Net cash received by a company during the from ACC 231 at Arizona State University. Use the following appropriate amounts to calculate net income.

/IncomeStatementFinalJPEG-5c8ff20446e0fb000146adb1.jpg)

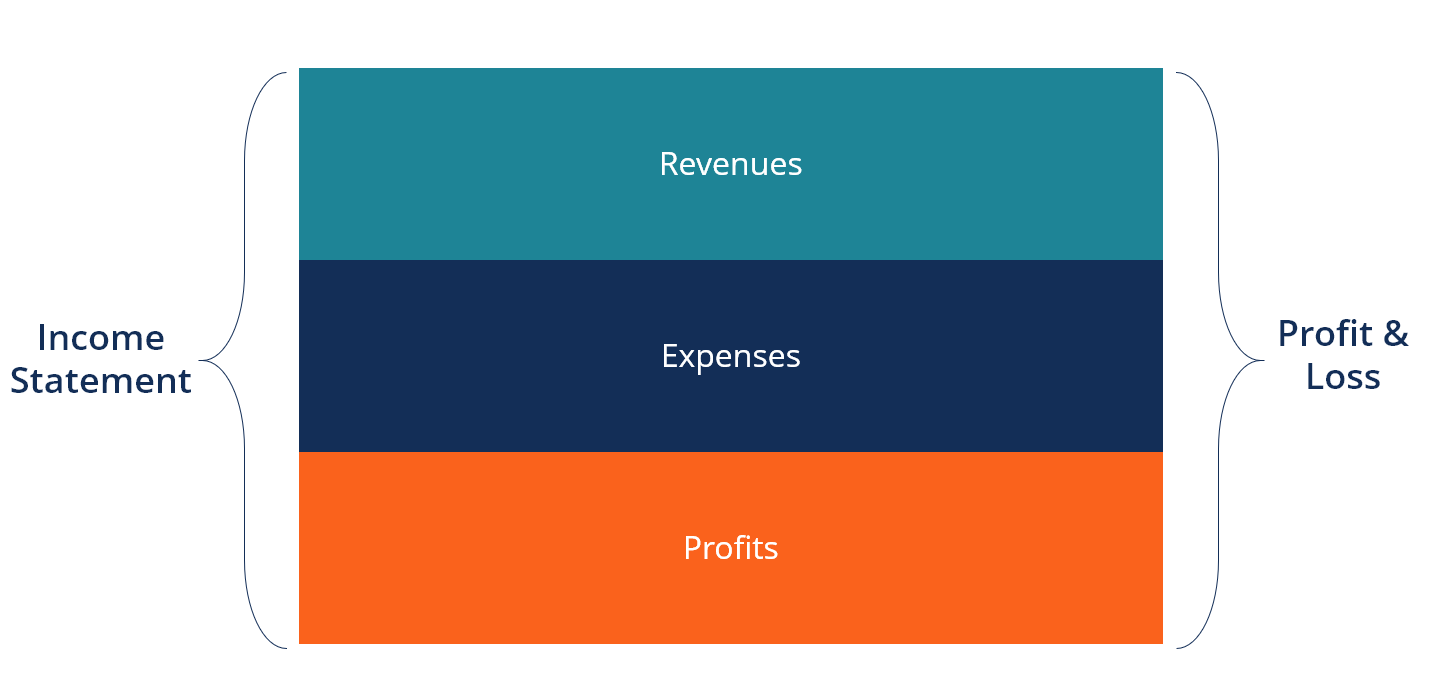

Income Statement Definition Uses Examples

Resources owned by a company.

/dotdash_Final_Free_Cash_Flow_FCF_Aug_2020-01-369e05314df242c3a81b8ac8ef135c52.jpg)

. The amount of profits retained in a company for the year. Investors should review the numbers used to calculate NI because expenses. B Gross income is revenue received before any reduction for cost of goods sold whereas net income is the.

A plug number used to achieve a pre-set level of operating income. Net cash received by a company during the year. Net income can also be called net profit the bottom line and net earnings.

A prepaid expense can best be described as an amount. Net cash received by a company during the year. Resources owned by a company.

The amount of profits retained in a company for the year. Collected and not currently matched with expenses. A The amount of net income over the life of the company.

Up to 25 cash back only actual amounts are reported in determining net income. Which of the following can best be described as a categorical variable. Ot POINTS DESCRIPTION 5 Insightful and well-crafted response that extends beyond the obvious interpretation of the picture and.

And net income 10000. Collected and currently matched with expenses. 43 The ending balance of Retained Earnings can best be described as.

The elimination of certain expenses to enhance budgeted income. Correct - Your answer is correct. The amount of profits retained in a company f.

The difference between gross income and net income can best be described as. 11 The income statement reveals A. Earnings per share are calculated using NI.

Net income can best be described as. Assets Liabilities Stockholders Equity. To profitably invest ones income in stocks and bonds government policies affect businesses and labour to manage business enterprises for profit the allocation of scarce resources meets needs and wants.

The planned overestimation of budgeted expenses. Not collected and currently matched with expenses. Economics can best be described as the study of how.

An accrued expense can best be described as an amount. Wrong - Your answer is wrong. Assets liabilities stockholders equity.

C The amount of cash received. Emmitt had the following final balances after the first year of operations. Net cash received by a company during the year.

Net income can best be described as. Gross profit considers operating expenses while net income does not. Net cash received by a company during the year.

Net earnings net income of a firm at a point in time. An alternative form of the accounting equation is. The amount of profits retained in a company for the year.

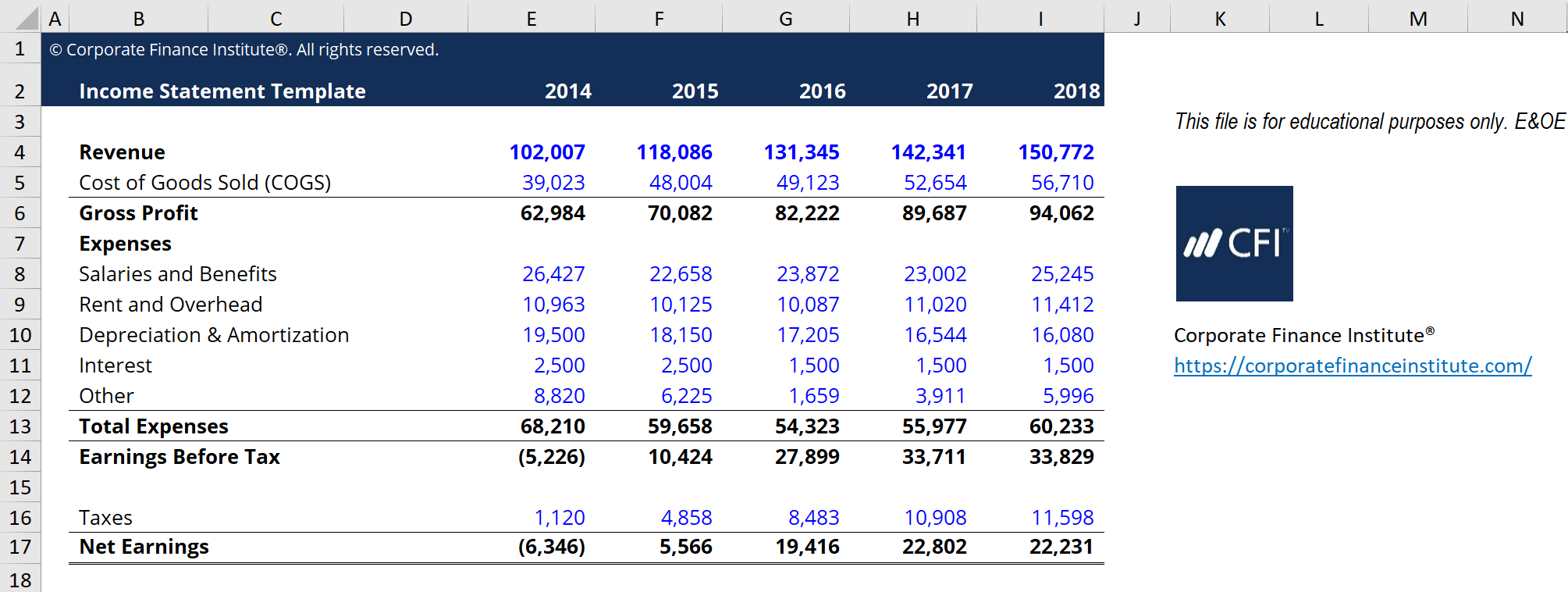

Net income also called net earnings is sales minus cost of goods sold general expenses taxes and interest. Net income considers operating expenses while gross profit does not. Gross profit deducts taxes while net income does not.

The amount of profits retained in a company for the year. Answered Net income can best be described as. The amount of profits retained in a company for the year.

Net income is the amount of money thats left after taxes and certain deductions are made from gross income. Net income NI is calculated as revenues minus expenses interest and taxes. Net income can best be described as.

Resources owned by a company. Net cash flows total cash inflows total cash outflows. Net income can best be described as.

Net income can best be described as. Net cash received by a company during the year. Net income can best be described as a net cash.

Resources owned by a company. Not paid and currently matched with revenues. Terms in this set 42 The accounting equation is defined as.

Ending retained earnings beginning retained earnings net income dividends. Not collected and not currently matched with expenses. Net income for a business represents the income remaining after subtracting the following from a companys total revenue.

Net income revenue expenses. An unearned income can best be described as an amount - 17409650 Rubric. B The amount of dividends paid over the life of the company.

Use the following appropriate amounts to calculate net income. Budgetary slack can best be described as. An unearned revenue can best be described as an amount.

Net income can best be described as. Net cash received by a company during the year. An unearned income can best be described as an amount Collected and currently matched with expenses O Not collected and currently matched with expenses O Not collected and not currently matched with expenses O Collected and not currently matched with expenses give an explanation.

Resources of a. Asked May 9 2021 in Business by Android. The planned underestimation of budgeted expenses.

Net income deducts taxes while. A Gross income is revenue received before any reduction for cost of goods sold whereas net income is the revenue received plus cost of goods sold operating expenses and taxes. Resources and equities of a firm at a point in time.

Which of the following statements best describes the difference between net income and gross profit. Net Income for Businesses.

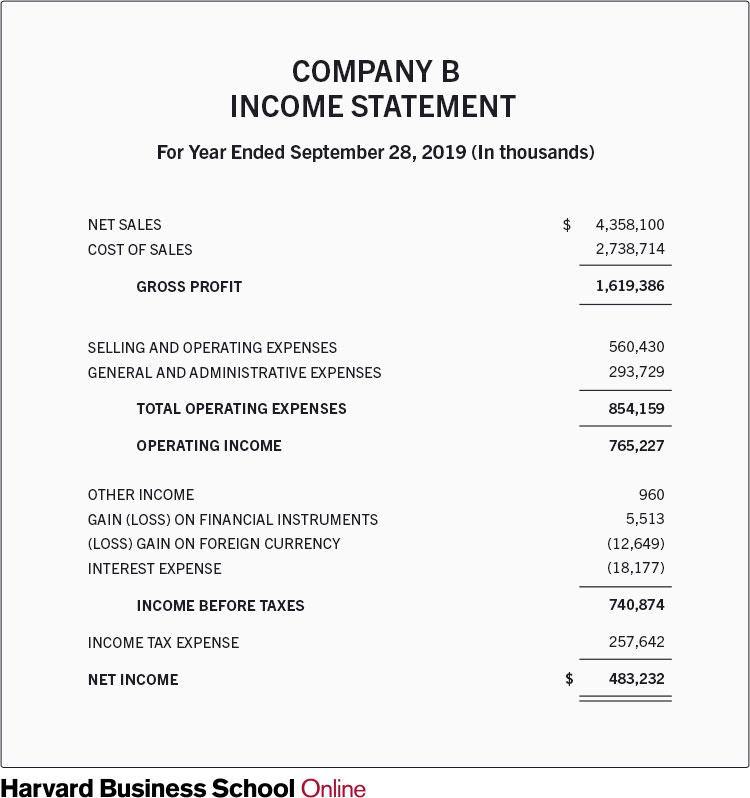

Income Statement Definition Explanation And Examples

Income Statement Analysis How To Read An Income Statement

Return On Equity Roe Formula Examples And Guide To Roe

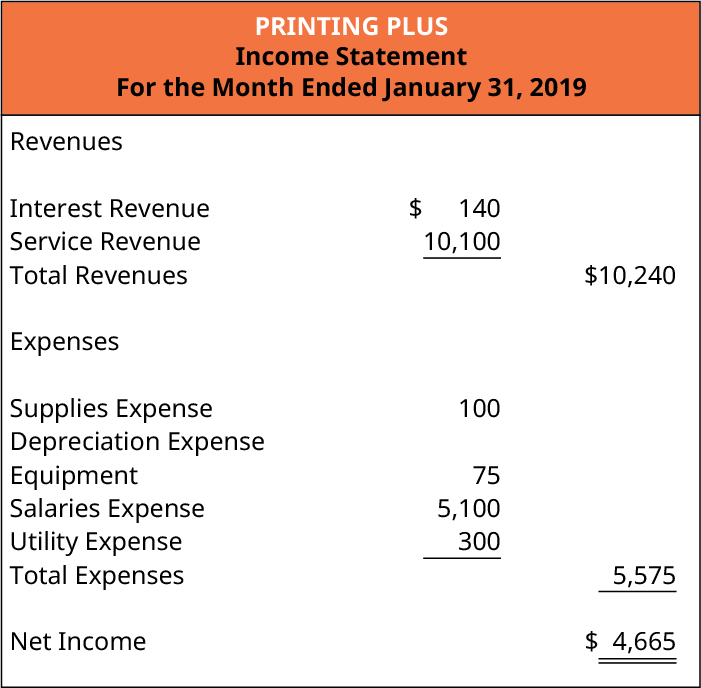

Prepare Financial Statements Using The Adjusted Trial Balance Principles Of Accounting Volume 1 Financial Accounting

Income Statement Definition Explanation And Examples

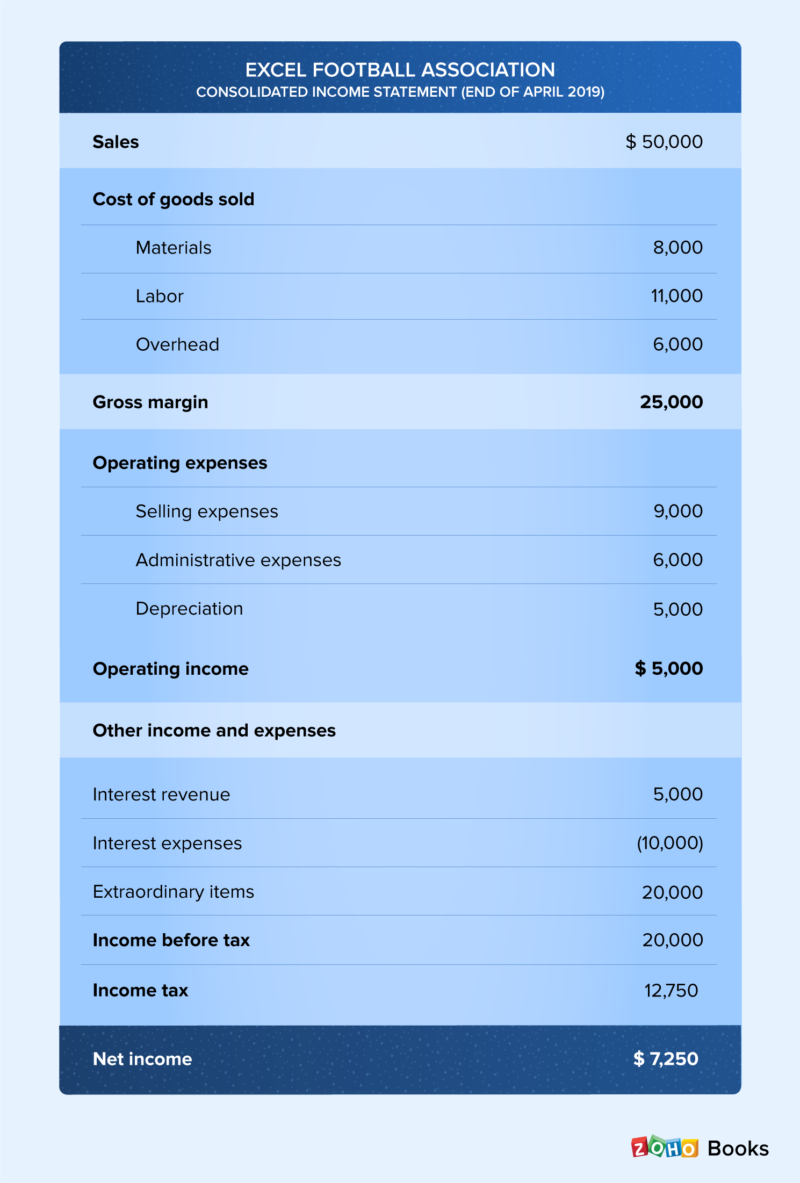

Income Statement Definition Example Format Of Income Statement Zoho Books

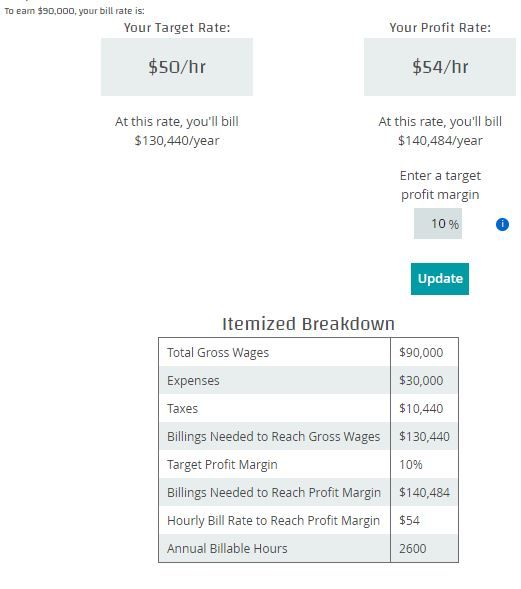

Gross Vs Net Income Differences And How To Calculate Mbo Partners

Income Statement Definition Explanation And Examples

:max_bytes(150000):strip_icc()/dotdash_Final_Gross_Profit_Operating_Profit_and_Net_Income_Oct_2020-01-55044f612e0649c481ff92a5ffff1b1b.jpg)

Gross Profit Operating Profit And Net Income

/dotdash_inv-gross-profit-operating-profit-and-net-income-july-2021-01-48310634db4240ba9a78ef19456430af.jpg)

Gross Profit Operating Profit And Net Income

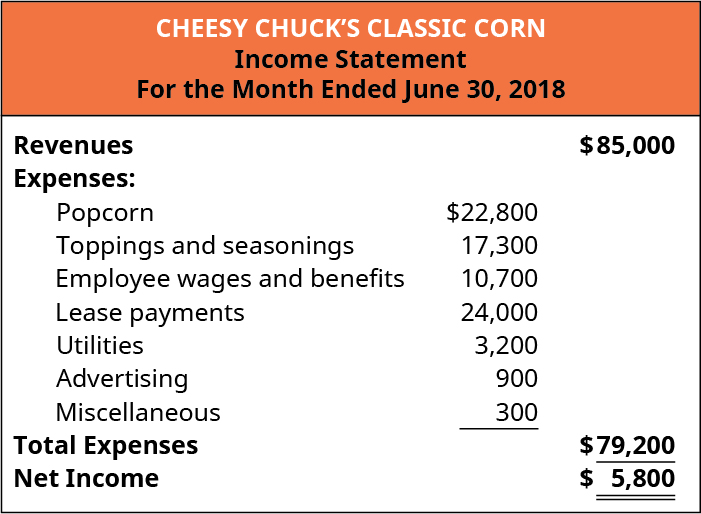

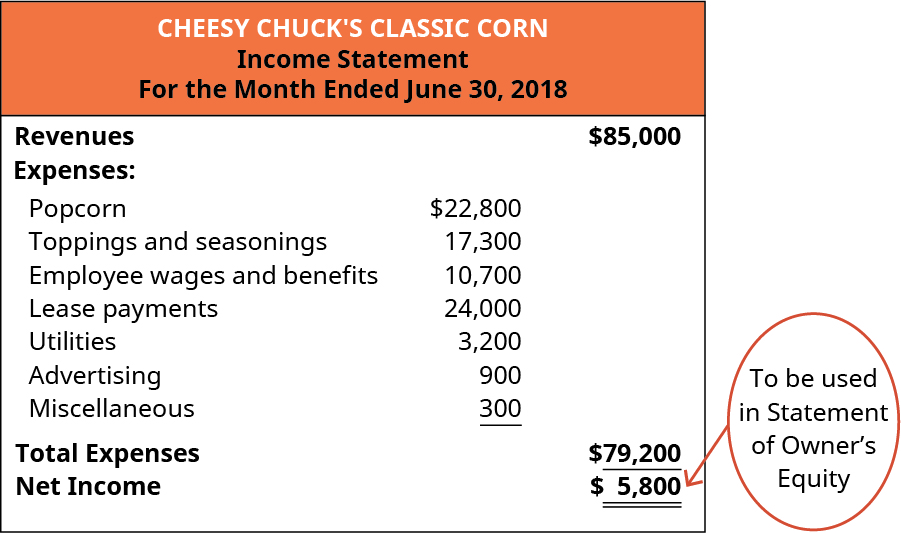

Prepare An Income Statement Statement Of Owner S Equity And Balance Sheet Principles Of Accounting Volume 1 Financial Accounting

Gross Vs Net Income Differences And How To Calculate Mbo Partners

Prepare An Income Statement Statement Of Owner S Equity And Balance Sheet Principles Of Accounting Volume 1 Financial Accounting

/dotdash_inv-gross-profit-operating-profit-and-net-income-july-2021-01-48310634db4240ba9a78ef19456430af.jpg)

Gross Profit Operating Profit And Net Income

/dotdash_Final_Financial_Statements_Aug_2020-01-3998c75d45bb4811ad235ef4eaf17593.jpg)

Financial Statements Definition Types Examples

Cash Flow Statement January February Transactions Accountingcoach

:max_bytes(150000):strip_icc()/AppleIncomeSattementDec2019-cd967d0a8f5e4748a1060f83a7e7acbc.jpg)

Comments

Post a Comment